Please click here for more information on our author services. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach you—or do the work for you. Our in-house team of bookkeeping, accounting, and payroll coaches. For questions about your Jeep® Brand vehicle, to schedule service, or for anything else you may need, simply call 844-JEEP-WAVE,24/7. You can also get in touch via email or by using the Live Chat option on your account page at any time.

This financial management platform is user-friendly and approachable — especially for those with no prior accounting experience — yet fully functional. It allows you to manage bookkeeping, accounting and invoicing in one place through internal integrations. QuickBooks Online offers four different plans to choose from and is well-known for its robust reporting, record-keeping and project tracking features.

How much does Wave cost?

Jeep Wave® members get preferred treatment at Jeep® Brand events across the country and access to exclusive events. Ability to turn estimates into invoices once approved. Support for non-paying users is limited to the chatbot and self-service Help Center. The New Mexico Office of Broadband Access and Expansion recently extended the deadline for Wave Three of the Connect New Mexico Pilot Program (“Pilot Program”). I am a disabled veteran who, due to medical issues, has a hard time driving the 2 hour trip to see my Veteran’s Administration doctor. Recently using face time and the doctor was able to diagnosis some basil cell cancer on my nose that I didn’t even know was there.

newsGP – Another COVID winter is coming. Is this the calm before … – RACGP

newsGP – Another COVID winter is coming. Is this the calm before ….

Posted: Fri, 14 Apr 2023 05:31:19 GMT [source]

Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. The total amount of your sale, including any sales taxes. Must be in the same currency as the bank or other account into which you receive payment for the sale.

Phone Number

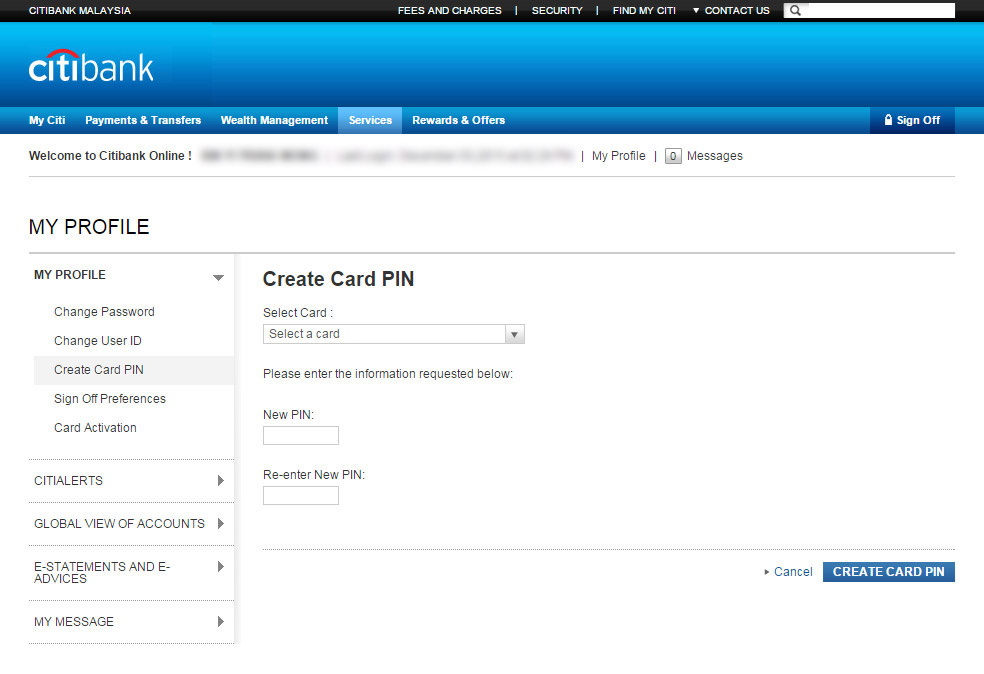

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. FreshBooks has an excellent mobile app that allows you snap photos of receipts, send invoices and track mileage. After providing a few basic details about your business — name, type, currency you use, address — you’ll have instant access to your free account. Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade.

It also complies with 501c3 meaninging standards and helps automate the reconciliation process. FreshBooks’ lowest-tier plan lacks some basic accounting features, like double-entry accounting reports, accountant access and bank reconciliation. And the first two plan tiers limit the number of billable clients. None of FreshBooks’ plans include an audit trail that accountants can review. Moreover, FreshBooks only includes one user with all of its plans, except the Select plan which includes two; to add users, you’ll need to pay $10 per person per month. QuickBooks Online doesn’t have a free plan, but offers four paid plans, each with additional features, making it a great choice for scalability.

- Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay.

- For information on applying to graduate and professional programs, visittulane.edu/academics/graduate-education/admission.

- You can also get in touch via email or by using the Live Chat option on your account page at any time.

- The webpage has links to the Notice of Funding Opportunity, Scoring Guide, Application, Interactive Broadband Map, FAQ, and other valuable resources.

- This financial management platform is user-friendly and approachable — especially for those with no prior accounting experience — yet fully functional.

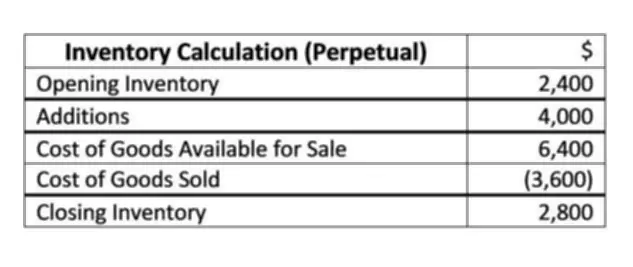

https://1investing.in/’s free accounting software can be a great option if you run a very small service-based business or don’t need more advanced features that alternatives might offer. For small businesses any larger than that, however, Wave is extremely limited. Unlike competitors, Wave doesn’t offer multiple plans to increase the software’s functionality. It’s also missing an audit trail and third-party integrations. It’s hard to beat free accounting software, especially if you’re running a small business on a budget. With Wave, you receive a lot of features, like unlimited invoices and unlimited users, that are not always included with paid accounting software plans.

Payment Processing Fee Amount

You can include more than one field from your source app, and also type extra text that tells you where this record came from. The amount of Payment Processing Fee deducted from the Sale Amount before you receive it. Payment Processing Fee Account required if providing Payment Processing Fee Amount. Create a new record or update an existing record in your app. Triggers when a new customer is added to a business you choose. By signing up, you agree to Zapier’s terms of service and privacy policy.

Colorado boy injured in shark attack while on spring break vacation in Mexico – The Denver Post

Colorado boy injured in shark attack while on spring break vacation in Mexico.

Posted: Wed, 29 Mar 2023 07:00:00 GMT [source]

With the higher-tier QuickBooks plans, you have access to time tracking, inventory management and employee expenses management, none of which are offered with Wave. Strong invoicing feature competes with that of paid products; app lets users send invoices on the go; offers significantly fewer reports than competitors; no inventory tracking. Small-business accounting software does have its limitations.

Additional Notes

Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments. Includes tools that help automate the reconciliation process; auto-categorizes transactions for you, but you can’t set up your own bank rules; no global search function. We believe everyone should be able to make financial decisions with confidence. To apply to pre-college and summer programs, visit summer.tulane.edu.

Compared with free software like Wave, QuickBooks plans are expensive. The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget. You may find that this software has a bit of a learning curve.

Allows an unlimited number of users; ideal for very small service-based businesses, freelancers or contractors; not ideal for businesses with more than a handful of employees. Must pay extra for phone support; live chat support only included with paid services . Billing Subscription billing built on top of Paddle User Profiles User profiles with image uploading and profile settings functionality.

The $123 million pilot program is funded by the American Rescue Plan Act’s Coronavirus Capital Projects Fund. OBAE launched the program in August 2022 and announced Wave One awards in November. An initial set of Wave 2 awards will be announced later in March and April.

Track your business expenses with our free accounting tools. FCA US LLC strives to ensure that its website is accessible to individuals with disabilities. Should you encounter an issue accessing any content on , please email our Customer Service Team or call IAMJEEP, for further assistance or to report a problem. Access to is subject to FCA US LLC’s Privacy Policy and Terms of Use. For more information about the Jeep Wave® program, visit our vehicle owner website for answers to your frequently asked questions.

Experts share tips on workplace violence prevention – WAVE 3

Experts share tips on workplace violence prevention.

Posted: Wed, 12 Apr 2023 23:01:00 GMT [source]

Sales Tax Abbreviation required if providing Sales Tax Amount. Creates a product or service in a business that you choose. We also provide many author benefits, such as free PDFs, a liberal copyright policy, special discounts on Elsevier publications and much more.

- With the higher-tier QuickBooks plans, you have access to time tracking, inventory management and employee expenses management, none of which are offered with Wave.

- If you need to manually edit, add or remove any transactions, you can do so on the Reconciliation or Transactions pages.

- For small businesses any larger than that, however, Wave is extremely limited.

- Once logged in, your main dashboard will show your cash flow, profit and loss, invoices, bills and other financial insights.

As soon as Tulane receives your application, you will receive an email notification with credentials to log into the Green Wave Portal and review your checklist. We have lived in a rural area with no options for high speed internet for the last 20 years. We were unable to assemble as a church during this stressful time. Having Wave installed in our home right before the pandemic started made it possible for us to stay connected to our church family. Thank you Wave for making a way for people in rural areas to have the same and even better quality high speed internet as those living in our urban areas. Fully Functional Blog Add blog posts to your application to drive-in organic traffic.